Democratized Prime RWA Lending Pool Surpasses $11.9 Million in Its First Month

Earn Your 9% With Democratized Prime

By Moustapha Saab

July 14, 2025

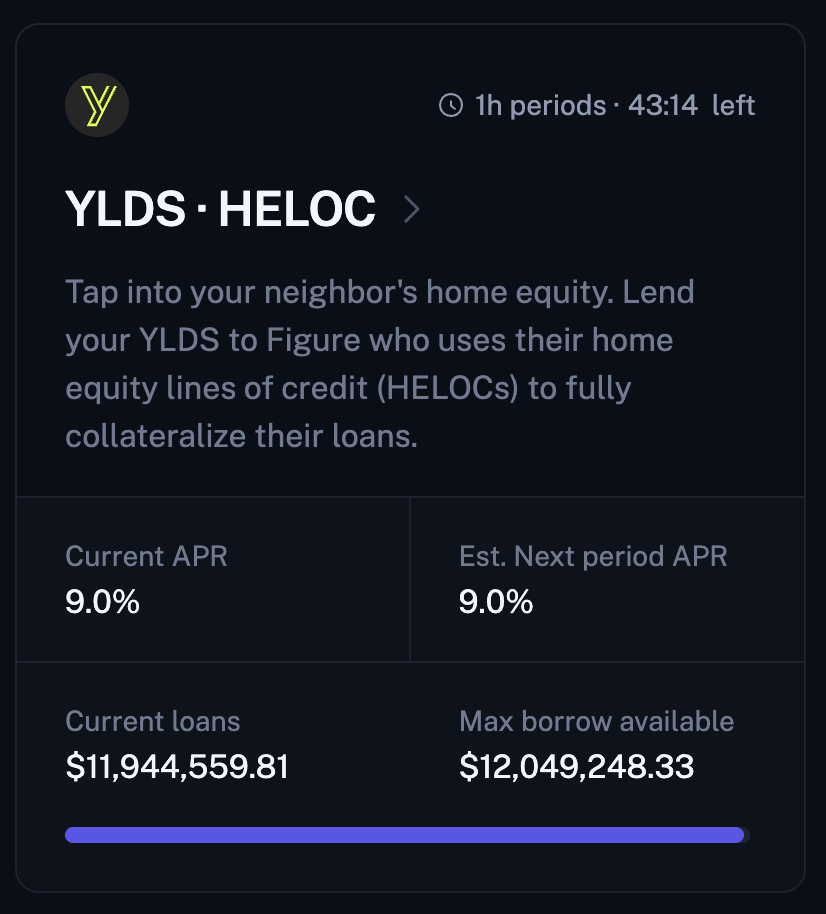

One month after launch, the Democratized Prime (DP) HELOC pool on Figure Markets has reached over $11.9 million in active deposits.

Users have earned 9% throughout, and we’re excited to share that Figure will soon be adding another $6.5M for you to lend against so rates can stay near 9% longer.

Want to earn 9% Yield too?

- Open the Figure Markets app

- Navigate to the Democratized Prime tab in the app → HELOC Pool

- Purchase YLDS first or if you already have some, choose your deposit amount and confirm

Once your offer is accepted, your funds start earning on the very next hourly roll. If you’ve been waiting to test the waters, now is the time to get started while you can earn a 9% yield.

How Figure Benefits - And How Institutions Can Too:

Figure is the largest non-back lender for HELOCs. In the past year, Figure has generated strong positive EBITDA. They want to borrow cash against some of their HELOCs to issue more HELOCs to homeowners, and in doing so, pass yield back to lenders - both retail and institutions alike. Figure’s loans are fully performing HELOCs and earn ~9.3 % but tie up 100 % of the firm’s equity in those loans.

Here’s how they freed up capital:

- Figure tokenized their HELOCs and dropped it into Democratized Prime on Figure Markets.

- An institution then stepped in and funded an 80% advance at 8%, paid in YLDS, an SEC-registered yield-bearing stablecoin which returns ~4% (SOFR - 50bps) at the moment, for an incremental 4% gain to 8% total.

- The freed-up equity will go into funding new HELOC originations. That means they were able to recycle capital instead of waiting for repayment which drastically increased ROE.

Result: ROE on the loans in the pool jumped from ≈ 9.3 % to ≈ 34 %.

For prospective institutional borrowers

Originators with qualifying collateral who wish to participate on the borrowing side may contact ncarmi@figuremarkets.com for details on eligibility and onboarding.